When it comes to money, many people are haunted by bad decisions that lead to long-lasting consequences. Financial mistakes can feel like nightmares, leaving you stressed and overwhelmed. However, with some knowledge and careful planning, even the most frightening financial missteps can be corrected. Below are some common scary financial mistakes and advice on how to fix them.

Scary Financial Mistakes and How to Fix Them

1. Ignoring or Avoiding Debt

Debt is often the ghost looming over our financial health. Many people make the mistake of ignoring their debt, hoping it will go away, or simply delaying payments due to lack of funds. The problem with this approach is that debt doesn’t just stay still; it grows due to accumulating interest, late fees, and penalties, making it harder to pay off over time.

Fix It:

The first step to taming this monster is facing it head-on. Make a list of all your debts, including the balances, interest rates, and minimum payments. Consider consolidating your debt into one loan with a lower interest rate, if possible. Prioritize high-interest debt (like credit cards) and set up automatic payments to ensure you never miss a due date. You can also explore debt management programs or consult a financial advisor for personalized strategies.

2. Not Having an Emergency Fund

Life is full of surprises—some of them expensive. Whether it’s a medical emergency, job loss, or a sudden car breakdown, not having an emergency fund can lead to relying on high-interest credit cards or loans, deepening your financial problems.

Fix It:

Start small but start today. Even if you can only set aside $50 or $100 a month, build a habit of saving consistently. Ideally, aim to have 3-6 months of living expenses saved in an easily accessible account. Set up an automatic transfer from your checking account to your savings, so the process becomes effortless. If you’re struggling to find extra cash to save, try cutting unnecessary expenses or exploring side income opportunities.

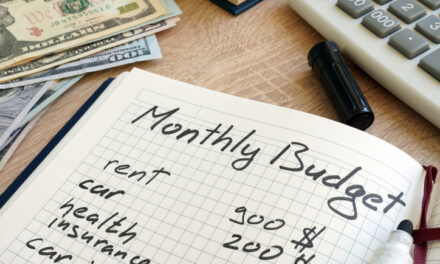

3. Living Beyond Your Means

Many people fall into the trap of overspending due to lifestyle inflation. As incomes grow, it’s easy to justify bigger purchases, thinking, “I can afford it now.” However, when spending consistently exceeds your income, you’re setting yourself up for financial trouble, such as accumulating debt and failing to save for long-term goals like retirement or a home.

Fix It:

The key to avoiding this mistake is to create and stick to a budget. Track your spending for a month to see where your money is going, and then identify areas where you can cut back. Consider adopting a “pay yourself first” mentality, meaning that you set aside money for savings and essential expenses before spending on luxuries. This ensures you’re living within your means and not overspending on things that aren’t truly necessary.

4. Neglecting Retirement Savings

It’s easy to prioritize current needs over future ones, but failing to save for retirement is a mistake that can haunt you later in life. Many people delay retirement savings, thinking they have plenty of time, but the power of compound interest diminishes the longer you wait.

Fix It:

Start saving for retirement as early as possible, even if it’s just a small amount. Take full advantage of any employer-sponsored retirement plan, like a 401(k), especially if your employer offers a match—this is essentially free money. If you don’t have access to such a plan, consider opening an Individual Retirement Account (IRA). Automate your contributions, and as your income increases, aim to save a higher percentage each year.

5. Not Having Insurance

A lack of adequate insurance can quickly turn a bad situation into a financial disaster. Whether it’s medical, auto, home, or life insurance, failing to protect yourself and your assets can lead to overwhelming costs if something unexpected happens.

Fix It:

Review your current insurance policies and make sure they cover your needs. For health insurance, consider both your current health and potential future medical expenses. For home and auto insurance, make sure you’re not underinsured—getting the cheapest policy may save money in the short term but leave you vulnerable later on. If you have dependents, life insurance is crucial. Ensure you’re properly covered based on your specific circumstances.

We Can Help You Fix Financial Mistakes

Financial mistakes can feel scary, but they’re rarely irreversible. The key is recognizing the problem, creating a plan, and taking proactive steps to resolve it. At DeSantis, Kiefer, Shall & Sarcone, our experienced team will help you stay on top of your financial health and plan for the future so you can avoid financial pitfalls. By facing your finances head-on, you can turn even the most terrifying money troubles into manageable tasks, setting yourself up for long-term financial success.